New to Cents of Direction? Welcome!

If you enjoy what you’re about to read, make sure to subscribe so you receive them each Friday!

I heard something interesting at the grocery store this week.

The guy ringing up my groceries telling the guy bagging my groceries the following:

“We’re for sure in a recession already. I’d wait for things to get worse, then buy.”

You’ve probably heard some variation of it lately as well or found yourself saying it. It’s hard to escape.

Despite being only two concise sentences, there is plenty to break down. I’m going to focus on a couple:

How a recession is defined

Why the technical definition of a recession matters less than sentiment and the self-fulfilling prophecy of a recession

Let’s start with how a recession is defined. It seems we’re currently being beaten over the head with part of the definition. It’s led to some awkward and mildly entertaining White House press conferences.

The part you’ve likely heard is back-to-back negative GDP quarters would constitute a recession. We found out Thursday, this did in fact happen.

But that’s not actually how a recession is defined.

The reality is this is an oversimplification. Everyone who cares knows that recessions happen when there are two consecutive quarters of negative growth — everyone, that is, except for the people who actually declare when the economy is in recession.

“Those people” who officially declare recessions are a part of the National Bureau of Economic Research (NBER), and the definition of recession may surprise you with the amount of nuance involved.

Officially, the NBER defines recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” The bureau’s economists, in fact, profess not even to use GDP as a primary barometer.

“The NBER would be laughingstocks if they said we had a recession when we were creating 400,000 jobs a month,” said Dean Baker, co-founder of the Center for Economic and Policy Research. “I can’t even imagine they would think for a second that we’re in a recession.”

NBER is a bit of an interesting group, meeting in private and not making recession calls generally until months after they begin, and sometimes not until after they’ve ended. A group of Monday Morning Quarterbacks of sorts.

I’m unsure whether arming you with this information will create better or worse cocktail party conversation, but take it for what it’s worth.

Second, and more importantly, I think the concept of a self-fulfilling prophecy is a key determinant in where we go from here and how severe the economic downturn gets.

In other words, can we talk ourselves into a recession? A “Vibecession” of sorts.

The worries among small business owners, consumers and others are illustrated by so-called Misery Indexes, which blend unemployment and inflation rates. The gauge for the US is already 12.2%, similar to levels witnessed at the start of the pandemic and in the wake of the 2008 financial crisis, according to Bloomberg Economics.

Psychology is turning sharply lower everywhere you look. If enough people believe it’s time to rein in their spending - and then act on that belief - it becomes a self-fulfilling prophecy.

If you pull back and I pull back, that’s the ballgame. The consumer is 70% of the US economy.

Even though the data might not yet support the recession calls, people instinctively know that something’s just not right.

Like your favorite sports team seeing a lead slip away from them and feeling the momentum shift, everyone in the arena (or in recession terms, the country) is feeling the same thing.

In some ways, capitalism’s success is built on a belief – a story – that, given the right incentives, people can work together to solve problems. It’s worked magnificently. It’s the greatest story ever told.

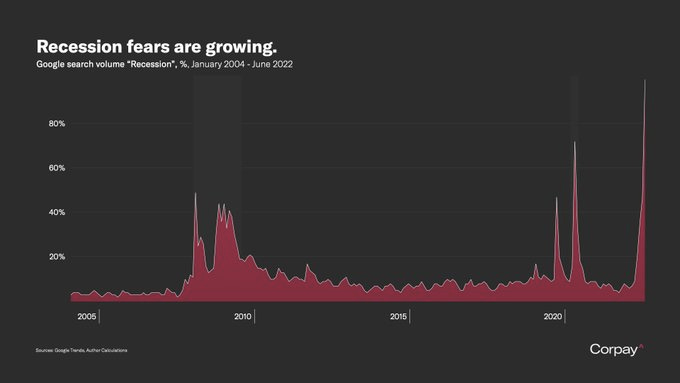

But the story works in both positive and negative directions. Just look at Google searches spiking for the word “recession”.

Mark Zandi, who has been an economist for more than three decades, says he’s never seen so many people convinced that a recession is imminent.

Zandi goes on to say:

I talk to CEOs, CFOs, investors, friends, family -- to the person, they think we’re going into recession. I’ve never seen anything like it. I’ve seen a lot of business cycles now. And no one predicts recessions. But in this one, everyone is predicting a recession. So when sentiment is so fragile, it’s not going to take a whole lot to push us in. I think with a little bit of luck, and some reasonably good policy-making by the Fed, we’re going to be able to avoid a recession. But I don’t say that with a lot of confidence.

The recession narrative is clearly picking up plenty of steam. As a corollary, Robert Shiller says this in his NY Times piece:

The probability that a recession will come soon — or be severe when it does — depends in part on the state of ever-changing popular narratives about the economy. These are stories that provide a framework for piecing together the seemingly random bits of information that one picks up from friends, the news or social media.

If enough people begin to act fearfully, their anxiety can become self-fulfilling, and a recession, sometimes a big one, may follow.

I agree with Shiller that narratives drive much of what goes on in the economy, especially at the extremes. And these stories can stay with us for long periods of time.

My hunch is that when inflation finally comes down, the narrative will shift. After all, inflation is much harder to ignore than a stock market decline. You don’t have to check your portfolio every day, but, every time you fill up at the pump or buy food, inflation is staring you right in the face.

More importantly, this inflation is affecting money that you have now, whereas a stock market decline affects money that you probably won’t need for decades. One is present value, the other is future value. And losing present value is far more painful.

You may have picked up on my grocery store clerk’s second sentence, too. It’s safe to say he was talking about timing the market. I’ll be dedicating a full piece to that part next week since times like right now are when we’re most tempted :)