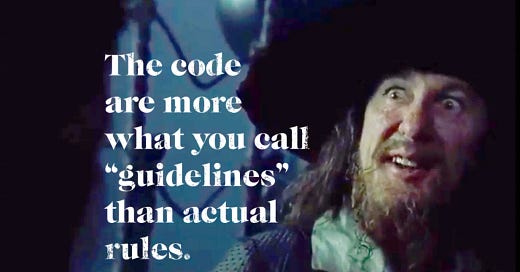

Though I haven’t seen the movie in years, there’s a line from Pirates of the Caribbean I find myself repeating all the time:

“The code is more what you'd call 'guidelines' than actual rules.”

When it comes to money, it’s easy to become obsessed with a code of rules.

Rules are specific. They’re often catchy with a fun jingle. They’re easy to remember. And they’re just downright more common (“rules to live by” will always be more common than “guidelines to live by”).

Unfortunately, code-like rules can also be far less useful than broader guidelines. Here’s why:

Rules often are rigid and don’t leave much room for error.

James Clear wrote in his 3-2-1 newsletter this week:

Maintain a margin of safety. If your life is designed only to handle the expected challenges, then it will fall apart as soon as something unexpected happens to you. Always be stronger than you need to be. Leave room for the unexpected.

Investing is a game built for the long run. Those competing in any other type of race typically don’t succeed. If you want to be in the game for the long run, you need to leave room for error. Room for error lets you endure a range of potential outcomes, and endurance lets you stick around long enough to fully reap the benefits of your hard earned savings.

The same goes for your cash cushion you keep. I used to despise having a dollar more than I needed in my checking account. But then a mistake charge hit my account and I overdrafted - and all of the sudden I thought differently. You’ll still never find me sitting on heaps of cash earning 0%, but it gave me a newfound appreciation for a little wiggle room.

Rules can oftentimes be too specific.

We’re probably all guilty of learning an overly precise lesson. This starts when we’re young. Maybe as a child, you got reprimanded by Mom for doing something. But that same thing went unnoticed by Dad.

What you probably learned was “don’t do that thing in front of Mom”. What you probably should have learned was “I shouldn’t do that thing at all.”

The same goes for personal finance mistakes.

In an interview with The Motley Fool, Jason Zweig of the Wall Street Journal said:

I often like to say that people are too good at learning lessons, and the lesson that people should have learned after the Internet bubble burst in early 2000 was that day trading is a really bad idea. But people are too good at learning lessons, so they learned an overprecise lesson, which was that day trading *Internet stocks *is a really bad idea. So in recent years we see the same people who day-traded internet stocks going into day-trading foreign currency.

Whether it’s 2008 or some other financial event that caught you off guard, the lesson ought to be broad.

The most useful lesson is that big risks hide under your nose and cause more havoc than you imagined, so having more room for error in your finances than you think you need is a smart idea.

There aren’t many ironclad rules in personal finance. But there are plenty of useful guidelines.