The past 20 days have been the 5th fastest 10% correction for the S&P 500 in the last 75 years. The speed of the downturn has been breathtaking, and emotions are running high.

Investing can be a very emotional process. Seeing your net worth explode higher or plunge in freefall can trigger every emotional response our bodies and minds can conjure up.

But if you zoom out, I think a big reason we’re so emotional about money is because of the work it required to obtain it in the first place.

Most things in life are like that. When you work hard for something and care about it, of course you’re bound to be emotionally-charged.

The kerosene + match-lighting combination to all of this is politics, arguably the most emotionally-charged topics in the world.

There was a Reddit post I came across, which has since been deleted (but I took a screenshot below).

It seems this person had a few things on their mind which led to the rash move of “screw it, I’m selling everything”.

Worried about President Trump’s policies

Losing money on huge gains in assets which appreciated like crazy over the last few years

Social media algorithms magnifying #1 and #2

And here are a few of the comments:

I did the same a few weeks back. Basically because I couldn't make any sense of what came out of the WH. I was well aware I could be wrong, but I did get peace of mind. No-one knows what's next, but there are probabilities and good old stomach sense.

None of us know what we’re doing. I sold first week of February and sure I look good now. But wait until I enter at the wrong spot and lose money 💴.

Usually you can't time the market, but in this case the president is deliberately crashing the economy with Tariffs, so yes we can time the market. Selling was the right decision, the fall has only just begun has quite a way to fall with the next round of tariffs.

These are the conversations happening all over the place right now…around water coolers, at cocktail parties, or on social media.

You’re allowed to be nervous. In one camp we have a left-leaning and/or “anyone but Trump” group who sees their worst fears coming to fruition.

And in another camp we have a group who probably voted for Trump and might be feeling some degree of buyer’s remorse where the outputs of Trump’s campaign message are requiring a messier set of inputs than they might have liked.

But I am here to tell you, even if you fall into these two camps, do not make wholesale changes to your investment plan and process.

Whatever you do, don’t.

Going all-in or all-out is a recipe for disaster, both for your returns and for your psyche.

Josh Brown wrote about 10 things you can do during times like these. The majority of them are either overly complex or downright psychotic, and that’s really his point.

The bottom line is you don’t have many options besides some combination of gritting your teeth, forgetting your login credentials (halfway kidding), or going for a walk to observe the world is still spinning on its axis.

If this recent market pullback had you losing actual sleep at night, then this might be the alarm bell you needed to make subtle tweaks to your portfolio to take less risk.

I can almost guarantee you won’t like the results in the long run if you do this, but sleeping at night is an important sniff test when investing.

I’m here to tell you that it’s okay to acknowledge there are risks in the world, and things could get worse. The trick is understanding these risks are the source of your future returns.

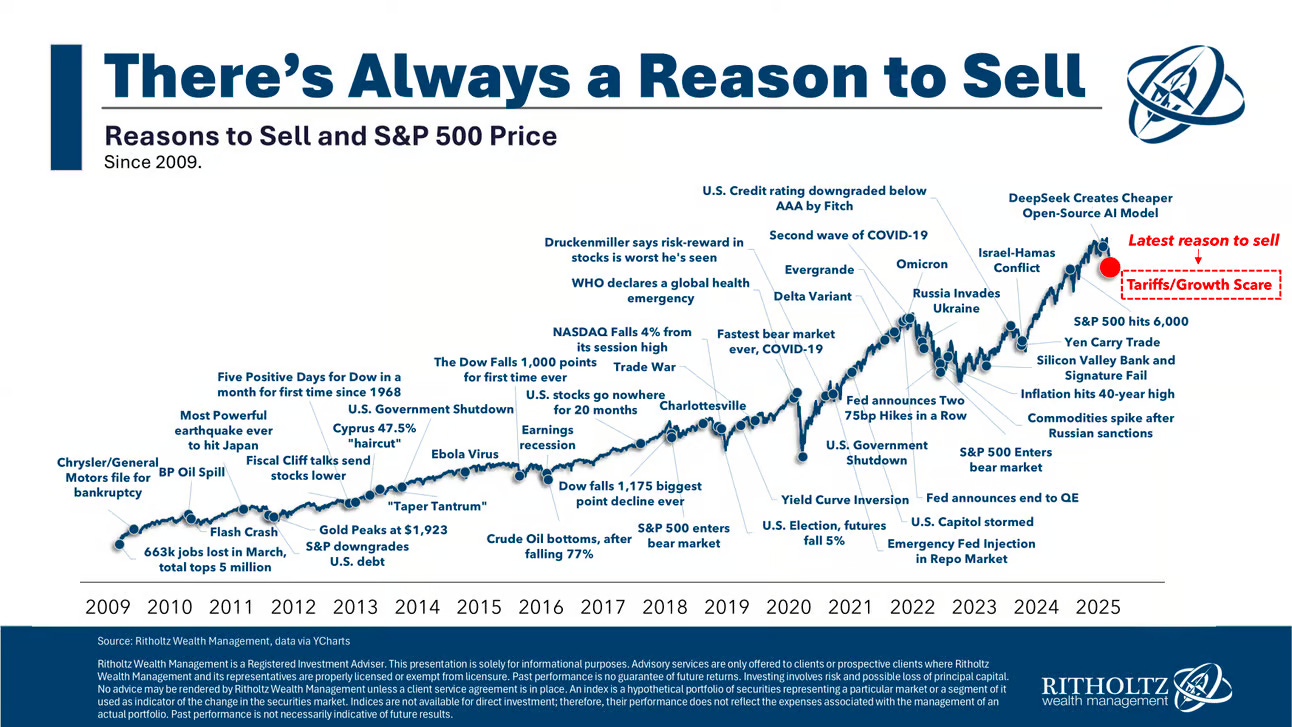

I love when Michael Batnick updates his “reasons to sell” chart.

In the end, this will be but another blip in the grand scheme of things. Blips can last for longer than we might like, but they always end and this chart will continue moving up and to the right in the long run.